For lots of, possessing a home is actually a lifelong dream. However, for those with lousy credit rating, securing a house loan can look like an not possible task. The good thing is, terrible credit rating mortgages exist specifically that will help persons with very poor credit score history reach their target of homeownership. While these home loans may well include certain troubles, they provide a pathway for borrowers who would otherwise wrestle to acquire approval from regular lenders.

In this post, We're going to check out what poor credit history mortgages are, how they work, their Added benefits and drawbacks, and guidelines for strengthening your chances of securing 1. Eventually, We'll introduce

What exactly is a foul Credit score Property finance loan?

A nasty credit history mortgage loan, generally known as a subprime mortgage loan, is usually a form of loan presented to individuals by using a less-than-best credit score. Common lenders, including banking companies and credit score unions, are likely to reject applicants with bad credit rating because they are witnessed as high-threat borrowers. Lousy credit score home loans, on the other hand, are exclusively built to accommodate these persons, permitting them to borrow dollars to buy a house.

Because of the greater possibility to your lender, undesirable credit mortgages normally have greater fascination fees and stricter phrases than typical mortgages. Nonetheless, they offer a valuable possibility for people with past money difficulties to rebuild their credit score when securing a house.

How Poor Credit rating Home loans Function

Undesirable credit history mortgages perform equally to standard mortgages, but They may be customized to borrowers who may well not meet the credit score necessities of traditional lenders. Normally, men and women which has a credit score underneath 600 are deemed for terrible credit mortgages. These loans could possibly have distinctive attributes in comparison to plain home loans, including:

Greater Curiosity Premiums

Considering the fact that borrowers with bad credit score are witnessed as significant-hazard, lenders charge greater curiosity costs to compensate with the increased danger of default. Because of this in excess of the life of the financial loan, chances are you'll finish up paying much more in curiosity when compared with another person with superior credit. Nevertheless, securing a mortgage loan with undesirable credit rating will give you the chance to make payments punctually, improving your credit score and possibly enabling you to refinance for any decrease fee Sooner or later.

Much larger Deposit

Lenders normally demand a greater deposit on terrible credit rating home loans to lessen their publicity to possibility. Though common home loans may perhaps allow for for down payments as little as three-five%, lousy credit history home loans ordinarily involve down payments of ten-twenty%. The greater you could set down upfront, the greater probable you will be to be approved, as it lessens the personal loan-to-value ratio (LTV) for the lender.

Stricter Loan Conditions

Lousy credit history home loans generally have stricter financial loan phrases, for example shorter repayment intervals and higher expenses. Some lenders may additionally position boundaries on the amount of it is possible to borrow, dependant upon your creditworthiness and fiscal record. However, with mindful arranging and budgeting, you could still attain homeownership with manageable payments.

Advantages of Undesirable Credit history Home loans

Pathway to Homeownership

The most significant benefit of poor credit score home loans is the fact they offer a pathway to homeownership for people who could possibly otherwise be denied by conventional lenders. For those who have very poor credit rating, a foul credit history property finance loan can help you secure a home although giving you the chance to Focus on strengthening your credit score score.

Possibility to Rebuild Credit rating

One of many lengthy-term great things about a nasty credit score home loan is the chance to rebuild your credit rating. By producing normal, on-time payments on your property finance loan, you may exhibit monetary obligation and little by little boost your credit rating. As your credit rating improves, it's possible you'll even qualify for refinancing selections with greater phrases and reduce desire costs.

Versatility in Acceptance

Not like traditional mortgages, terrible credit score home loans in many cases are a lot more flexible with regard to approval. Lenders who specialize in terrible credit score financial loans know that economic setbacks can happen, and They might be much more prepared to operate with you Irrespective of your credit score history. This overall flexibility tends to make lousy credit home loans accessible to the wider range of borrowers.

Downsides of Poor Credit history Mortgages

Higher Fascination Costs

As stated earlier, lousy credit score home loans have a tendency to have increased interest premiums than standard financial loans. Because of this, eventually, you can pay more in fascination, potentially rising the overall price of the loan. On the other hand, If you're diligent in building your home finance loan payments, you might have the choice to refinance at a decreased price Sooner or later.

Bigger Money Commitment

The prerequisite for a larger down payment might be a problem For lots of borrowers. For those who have lousy credit score, it's possible you'll currently be experiencing monetary complications, and coming up with 10-twenty% of the home's acquire price might be an important hurdle. Nonetheless, setting up and saving beforehand will let you satisfy this need.

Restricted Lender Possibilities

Not all lenders offer negative credit history mortgages, so your options may very well be limited when compared with those with excellent credit rating. You will need to analysis and come across lenders that specialize in subprime loans, which often can take time. Working with a home finance loan broker or advisor can help you navigate this process and discover the most effective deal on your instances.

How you can Increase your Odds of Securing a Bad Credit score Home finance loan

Look at and Enhance your Credit rating Rating

Before applying for the terrible credit house loan, it’s vital to check your credit score score and fully grasp your financial standing. If possible, get measures to help your credit score by shelling out down existing debts, producing well timed payments, and preventing new strains of credit. Even a slight improvement with your credit rating rating can increase your probabilities of securing a mortgage loan and recuperating conditions.

Help you save for a bigger Deposit

A larger down payment decreases the lender’s chance and boosts your odds of getting authorized. In addition, it lowers the amount you must borrow, which may lead to improved personal loan terms. Saving for a substantial down payment demonstrates to lenders that you're monetarily dependable and devoted to homeownership.

Get the job done that has a Property finance loan Broker or Advisor

Navigating the mortgage market may be difficult, especially if you've got negative credit rating. Dealing with a house loan broker or advisor who concentrates on terrible credit rating home loans may help you obtain the ideal lender and personal loan products for your circumstance. Brokers have use of a wider array of lenders and may negotiate far better terms in your behalf.

Get Pre-Accepted to get a Home loan

Acquiring pre-authorized to get a home loan prior to home hunting gives you a transparent notion of exactly how much you could borrow and can help you center on residences in your funds. Furthermore, it displays sellers that you're severe and financially capable of finishing the acquisition. Pre-acceptance can also Offer you an advantage in competitive housing marketplaces.

Display Fiscal Security

Lenders need to see that you're financially stable, even when your credit rating isn’t great. Ensure that you supply proof of consistent money, discounts, and also other property that can help demonstrate your power to repay the financial loan. For those who have a steady job or have a short while ago compensated off considerable debts, highlight these factors over the house loan application process.

Possibilities to Terrible Credit score Mortgages

When you are worried about the large costs affiliated with terrible credit score mortgages, you will discover different choices to consider:

FHA Financial loans

In a few countries, governing administration-backed financial loans, like FHA financial loans, can be obtained for individuals with bad credit history. These financial loans frequently come with decrease down payment prerequisites and a lot more lenient credit score rating thresholds, generating them a beautiful alternate to subprime home loans. Nevertheless, They could include additional expenses, including mortgage insurance policies premiums.

Guarantor Home loans

A guarantor mortgage loan allows you to Use a member of the family or shut Pal act as a guarantor about the mortgage. The guarantor agrees to address the mortgage loan payments if you are not able to, which minimizes the lender’s possibility. This will help you protected a mortgage loan Despite having undesirable credit, as being the lender will base their final decision around the guarantor’s money standing.

Rent-to-Individual

In some instances, it's possible you'll contemplate a hire-to-very own settlement, which allows you to lease a residence with the option to acquire it in a later on day. Component of your respective rent goes toward the acquisition value, letting you to save for your down payment although improving upon your credit score rating. Rent-to-possess is usually a choice for people who aren’t yet willing to qualify for just a mortgage loan but want to operate toward homeownership.

Conclusion: Get Qualified Help with Undesirable Credit history Mortgages from MortgagesRM

Should you have bad credit score and they are struggling to safe a property finance loan,

Having a wealth of practical experience during click here the home loan market,

Choose

Contact

Mortgage Advisor | Fee Free | MortgagesRM

Address: Stoops Rd, Bessacarr, Doncaster DN4 7ES

Phone: 01302361361

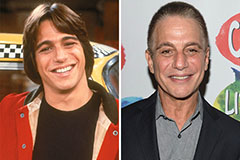

Tony Danza Then & Now!

Tony Danza Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now!